NEW DELHI: The government is likely to keep peak Customs duty rate of 10% unchanged in the forthcoming budget to protect the domestic industry as a number of countries look to export their way to growth.

India had committed to lowering its import duty to the Asean level of 4.5%-5 % by 2010 but the financial crisis triggered economic turmoil caused it to pause the reduction.

“The general view is that the rate should be left untouched as domestic industry is still recovering,” said a government official privy to discussions.

Peak customs duty is imposed on more than 90% of imported goods and retaining it at the existing levels would help protect the domestic industry from cheap imports.

India’s domestic demand driven 9% GDP growth is a big contributor to the global demand and a number of countries are looking to step up exports to India.

These include the exports driven economies of Asia that face stagnant demand for their goods in the developed world.

Moreover, India has entered into number of regional and free trade agreements including thatwith Asean. Once in effect these arrangements also lead to reduction duties thereby impacting local industry here.

However, duty on inputs could be cut to boost domestic manufacturing and also help ease inflationary pressures.

The then Finance Minister P Chidambaram had last reduced peak customs duties to 10% from the present level of 12.5% in February 2007 budget.

The duties have remianed at that levels since then.

The industry lobbies have said a reduction in peak duties at this juncture could spell trouble for the domestic industry.

FICCI has said in its pre budget presentation that it would be in fitness of things if the alignment in customs tariff is calibrated with internal reforms.

Domestic manufacturers in sectors such as airconditioners, refrigerators, washing machines , picture tubes, specified plastics and other capital goods would benefit if the peak duty of 10% is retained.

India’s imports have risen 24% to over $221 billion in April-November 2010 from a year ago.

Thursday, January 6, 2011

Keeping home safe: Peak Customs duty to stay at 10%

Labels: Budget, Customs, Finance Ministry 0 comments

Wednesday, January 5, 2011

Varanasi silk industry in trouble

In recent times, huge import of Chinese silk fabrics is posing a threat to the Varanasi silk industry, largely dominated by MSMEs. To voice this concern, the silk industry even observed a 1-day strike in late November 2010, but the Centre remained unmoved.

In recent times, huge import of Chinese silk fabrics is posing a threat to the Varanasi silk industry, largely dominated by MSMEs. To voice this concern, the silk industry even observed a 1-day strike in late November 2010, but the Centre remained unmoved.

The current scenario: There is 10% customs duty on silk fabrics and 30% on raw silk. On the contrary, the general trend followed worldwide is a lower customs duty on raw material over that of finished products.

To retain monopoly in the global silk fabrics export market, China has adopted a smart strategy, whereby it has increased raw silk prices to Rs 2,900 at present from Rs 1,750 in August 2010. However, current raw silk exports from China are almost nil, according to G K Kedia, convenor of Yarn Development Committee of the Banarasi Vastra Udyog Sangh (BVUS).

Consequently, China exports silk fabrics at skyrocketing prices and taking advantage of India’s reverse import duty structure, it is enjoying dumping of the same — adversely affecting the domestic silk fabric traders, which are mostly MSMEs.

In a major endeavour to protect the interest of the silk players, the Yarn Development Committee has recently written to the Finance Ministry and the Commerce Ministry requesting to abolish the import duty on raw silk and raise the same to 40% on silk fabrics.

“Huge Chinese dumping following inverted import duty structure, coupled with non-availability of requisite silk yarn is impacting the Varanasi silk industry,” said an official of BVUS to a correspondent on conditions of anonymity.

The problem

According to the government, the import duty on raw silk is higher to save domestic producers. But the point is that Indian raw silk is far below the quality of Chinese silk due to the following reasons:

•Poor cocoon quality

•Use of obsolete reeling machines to make yarn

Another disadvantage of Indian raw silk is that it needs twisting, while Chinese raw silk does not require twisting before use.

To add to the sector’s woes, domestic raw silk producers have raised prices at par with Chinese raw silk.

“Recent times have been really bad for the region’s silk players, primarily due to influx of Chinese silk at high costs,” said V Jamal, proprietor of Jamal Silk Palace, a small silk trader in Varanasi.

These factors have prompted domestic silk players to explore newer territories with zero import duty, such as Korea, Brazil, Iran and Vietnam.

Labels: Textiles 1 comments

Tuesday, January 4, 2011

Manmade fibre industry seeks govt help

Soaring cotton yarn prices followed by 25-40 per cent rise in man-made fibres (MMF) across various categories since October 2010 is making the export industry see red.

Export of MMF textiles declined by one per cent to Rs 3,852 crore during the second quarter ended June 2010, compared to the corresponding period in the previous year. The export scenario worsened with exports dropping by around 20 per cent to Rs 3,464 crore in the second quarter ended September 2011 as against Rs 4,910 crore during the same period last year.

The Indian MMF export sector was one of the few segments that was not affected by the global economic crisis. Exports during 2009-10 had registered a growth of nearly seven per cent at Rs 16,900 crore.

Industry insiders said the decline in MMF exports was because of significant rise in raw material costs, weak demand in Dubai and introduction of anti-dumping duties for synthetic and polyester yarn in consuming countries like Peru and Brazil coupled with an appreciated rupee.

“Polyester and viscose fibre and yarn prices have been increasing on a day to day basis. Manufacturers are also faced with erratic and unreliable supplies from fibre companies. This is making it difficult for exporters to plan their shipments and to adhere to delivery schedules,” said VK Ladia, chairman of the Synthetic and Rayon Textiles Export Promotion Council (SRTEPC).

Ladia said the industry will not be able to meet the MMF export target of $370 crore set by the government.

“I do not expect the just-ended quarter (Oct – Dec 2010) to be any better and the last quarter will not be able to make up for the loss. We will not be able to meet the target and our exports will be around $ 340 crore.”

Labels: Textiles 0 comments

EEPC seeks Technology Upgradation Fund Scheme

The Engineering Export Promotion Council (EEPC) has suggested the formulation of a Technology Upgradation Fund Scheme (TUFS) for the engineering sector. It feels this will help India achieve the target of doubling exports in three years.

The department of commerce is coming up with a strategy to double total exports in the next three years. The engineering sector (comprising 60-65 per cent SMEs) has been set an export target of $92 billion by 2013-14, up from an estimated $43 billion in 2010-11. To achieve the target, it has asked EEPC to identify major initiatives required in the Foreign Trade Policy.

The convenor of EEPC’s hand tools panel, Sharad Aggarwal, told Business Standard, “After a meeting on held December 27 with the department of commerce, EEPC India feels that the formulation of a TUF scheme will go a long way in not only helping engineering exports reach $92 billion by 2013-14, but also making India an important engineering export nation by 2020. The fund will help the SMEs in achieving the desired target.”

In spite of massive growth in the last few decades, the Indian engineering sector suffers from severe technological obsolescence and lack of economies of scale. High-value-added products contributed less than 10 per cent of total engineering exports in 2008-09. The need is to step this up to 20-25 per cent in the near future.

The main objective of the TUFS would be to provide the necessary policy wherewithal for modernisation of the engineering sector.

Technology upgradation would mean a significant step-up from the current technology level to a substantially higher one involving improved productivity, improvement in the quality of products and/or improved work environment.

It would also include installation of improved packaging techniques as well as anti-pollution measures and energy conservation machinery. Further, units that need to introduce facilities for in-house testing and quality control would qualify for assistance, as this is a case of technology upgradation.

The scheme will be available for sourcing of capital goods, machinery and equipment, clean technologies and tooling for production of value-added goods.

EEPC sought a corpus fund of Rs 500 crore for the scheme to boost R&D in the Indian engineering sector. The fund can be created through the public-private partnership (PPP) model, where the engineering industry may be asked to contribute 49 per cent while the government chips in with 51 per cent.

EEPC has also stressed the need for creation of a skill development fund for the engineering industry on the lines of the textile industry policy, to encourage capital equipment purchases on easy finance; a level playing field with respect to financing; a national raw materials policy; and a change in bank lending policies to treat VAT and excise duty receivables by exporters as the primary security for export credit.

Labels: Engineering 0 comments

Exports up 27 % in November

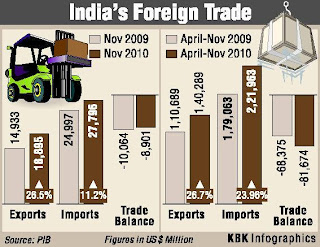

With exports registering a healthy growth of 26.5 per cent during November 2010 at $18.8 billion, the Commerce Ministry officials were confident that the overall exports would easily breach the $200 billion target set for this fiscal.

With the Western economies showing signs of revival and the formula to look out for new areas and markets for Indian products paying rich dividends, India's exports grew by 26.5 per cent year-on-year to $18.8 billion in November from $14.9 billion in the same month in the previous year.

On the other hand, imports rose by 11.2 per cent to $27.7 billion, leaving a trade gap of $8.9 billion, according to data released by the Commerce and Industry Ministry on Monday.

Oil imports increased by 2.31 per cent to $7.7 billion from $7.5 billion. Non-oil imports during the month grew by 15 per cent to $20.07 billion from $17.44 billion in November 2009.

During April-November 2010, shipments increased by 26.7 per cent to $140.2 billion from $110.6 billion in the year-ago period. Imports were higher by 23.9 per cent at $221.9 billion against $179 billion in the corresponding period last year. The trade deficit stood at $81.6 billion and is expected to be in the range of $120-125 billion.

During April-November, oil imports rose by 21.4 per cent to $64.8 billion from $53.4 billion in the year ago period. Non-oil imports too went up by 25 per cent to $157.11 billion from $125.64 billion. Sectors which performed well during April-November include engineering goods, petroleum and refinery items and cotton yarn.

The Federation of Indian Export Organisations (FIEO) predicted that exports could touch $220 billion, sharing the optimism of the Commerce Ministry. “Exports may reach the new milestone of $220 billion this fiscal,” FIEO President Ramu Deora said.

The government had fixed an export target of $200 billion for 2010-11. In 2009-10, shipments had declined by 4.7 per cent to $176.5 billion under the impact of global slowdown.

“The continuous increase in trade deficit is a worrying issue. The government should devise a strategy to reduce the trade deficit,” Mr. Deora said.

Labels: Commerce Ministry 0 comments

Govt reimposes 60% duty on sugar imports

With sugar production set to exceed domestic demand, the government has decided the zero duty regime on sugar imports to lapse, which in effect will restore 60% duty on the sweetener. Import duty on sugar was abolished in early 2009 to boost domestic supply because of a short fall in output in 2008-09 sugar year (October –September). Before that the duty on sugar import was 60%. The duty free regime was valid till December 31.

“There is no need for a fresh notification with the validity of duty free import notification on sugar lapsing. It will automatically revert to 60% duty. If required we can seek a reduction in duty later,”a senior government official said.

India had imported about 6mt of sugar since February 2009 to meet domestic demand. Sugar production in India, the world’s second largest producer, had declined to 14.7mt in 2008-09against the annual domestic demand of 23mt . In 2009-10, the production improved to 19mt, but it was still short of demand. However, in the current sugar year, production is expected to rise to 24.5mt and the country has now begun exporting the sweetener. Prices have also softened to Rs 30-32 per kg in retail from nearly Rs 50 a kg in mid-January 2010.

Meanwhile, the government would notify export of sugar under the open general licence (OGL) this week. The government might give mills three months to export sugar under the OGL. Agriculture minister Sharad Pawar had last month said the government had decided to allow mills to export about 5 lakh tones of sugar under the OGL. Mills may be allowed to export 2.5% of their average annual sugar output since 2008-09 under the OGL.

Labels: commodities 0 comments