Export-Import (Exim) Bank of India, the apex financial institution fully owned by the government of India, will be releasing a fresh line of credit to Africa in the next three years, according to bank’s managing director T C A Ranganathan.

Speaking on the sidelines of the inaugural day of the India-Africa Business Partnership Summit here on on Wednesday, Ranganathan said: “At present, our exposure to Africa, in terms of sanctioned credit line, is more than $3.5 billion (which has not yet been fully disbursed), with the outstanding being around $2.75 billion. With the additional line to be issued in three years, we expect the total book size of Exim Bank on Africa to double in the next five years.”

Stating that the Exim Bank of India’s intent was to promote and provide entry to various Indian entrepreneurs to Africa, besides encouraging them to bid for projects in that continent, he said Indian entrepreneurs need to do projects on their own in Africa, as that was how their counterparts in Europe, the US, China and other parts of Asia were doing there.

“There is a vast growth that is taking place there. The continent is growing rapidly and holds huge potential. Therefore, Indian entrepreneurs should explore that continent,” he said, adding bilateral trade between India and Africa had more than doubled from $25 billion in 2006-07 to $53.3 billion in 2010-11 due to the rise in both exports to and imports from the African region.

Indian exports to Africa had risen from $10.3 billion in 2006-07 to $21.1 billion in 2010-11, primarily due to an increase in exports of transport equipment and petroleum products, Ranganathan said.

Besides providing line of credit to the continent, he said, Exim Bank of India was also financing Indian companies investing in Africa or those Indian companies selling in Africa through buyers’ credit or through investment finance.

“For instance, we had assisted Tata South Africa for their vehicles to export to various members countries in Africa by giving a buyers’ credit to the governments there. In April this year, we have launched a new scheme where we will take insurance protection from a national insurance export account and give non-recourse long-term buyers’ credit on behalf of the Indian project exporters if the counter party is a sovereign of good standing,” Ranganathan said.

Stating that the Exim Bank of India had been giving credit lines to various banks in Africa, with the latest being $100 million to the Nigerian Export-Import Bank, he said the bank was trying to promote all forms of business in that continent, based on the request of the host country and the projects that they submitted to the Indian government.

Friday, October 14, 2011

Exim Bank to issue $5-bn fresh line of credit to Africa

Exporters get Rs 900 crore relief package

NEW DELHI: The government on Thursday announced a Rs 900-crore package for exporters to help them tide over the slowdown in developed markets and rising input costs. RBI has already announced interest subsidy of 2% on rupee export credit for handicrafts, handlooms, carpets and small and medium exporters. Along with the interest subsidy the total relief package for exporters stands at nearly Rs 1,700 crore.

Sectors which would benefit from the government move on Thursday include engineering goods, pharmaceuticals and chemicals, apparels and others. Commerce minister Anand Sharma unveiled a special focus market scheme, which would help diversify the country's exports to new markets. Under the scheme, an additional 1% duty credit would be provided to exporters, who ship their goods to markets in Latin America, Africa and CIS countries. The total number of countries in the scheme is 43 and includes new entrants Cuba and Mexico.

"These are not easy times for the exporting community. The shroud of economic uncertainty still envelopes the global economy. The troubles which began with a sovereign debt crisis in Europe last summer continue and still linger. Actually things have become even more serious thereby sapping both business and consumer confidence in one of our largest markets - US. We have to ensure that export growth continues," Sharma said. The commerce ministry has undertaken a series of measures to open up new markets to counter the slowdown in the country's traditional markets like US and EU.

"My guess is in a ballpark range, excluding interest subvention, it will be roughly around Rs 800-900 crore. For interest subvention it will be around Rs 800-Rs 1,000 crore... roughly about Rs 1,700 crore," commerce secretary Rahul Khullar said when asked about the total outgo on the schemes.

Fifty products in engineering, pharmaceuticals and chemicals would get special bonus of additional 1% of export value between October and March in the current financial year. "It is a Diwali bonanza. We were not expecting this much," said Ramu Deora, president of the Federation of Indian Export Organisation (FIEO).

Sharma also said the government had set up a panel comprising the finance secretary, commerce secretary, and secretary financial services which would address the issues of availability of dollar credit. "I have discussed the issue with the finance minister and we will ensure continued availability of dollar credit," he said.

The commerce minister was confident of meeting the $300 billion target for exports set for 2011-12. But he said the global economic slowdown posed a tough challenge. Exports are estimated to have risen 52% to $160 billion in the first half of the current financial year on the back of robust performance from engineering goods and petroleum products.

Industry groups cheered the move saying it would help Indian exporters in the current challenging global environment. "Additional benefits in terms of Special Focus Market Scheme, Special Bonus Benefit Scheme and support to apparel sector would be vital in stepping up the competitiveness of our exports," said Rajiv Kumar, secretary general of Ficci.

Labels: Commerce Ministry, DGFT 0 comments

Friday, September 23, 2011

Govt notifies new duty drawback rates for 4000 export items

Exporters will get lower tax refunds from October 1, as the Union finance ministry on Friday announced a new Duty Drawback Scheme, ending the 14-year-old Duty Entitlement Passbook Scheme (DEPB).

To provide a smooth transition from the popular tax credit scheme to the drawback scheme, the ministry said the drawback rate would have a floor rate of 5.5 per cent of the value of export consignments for most items.

The decision, taken after years of dallying, to neutralise the input tax paid on duties, may primarily affect companies in the engineering sector, including automobiles and the auto component industry, chemicals, textiles, pharmaceuticals and the marine sector, which were major exporters, getting the benefit of the DEPB scheme.

The finance ministry has softened the blow, as the new duty drawback rates will mean a moderate reduction of one to three per cent in the existing DEPB rates. The lower reduction has been provided only for the current financial year and the rates may be rationalised next year.

“Since the DEPB scheme will not continue beyond September 30, it has been decided to provide a smooth transition for these items, while incorporating these in the drawback schedule. As a transitory arrangement, these items will suffer a modest reduction in the existing DEPB rates, to the extent of one per cent to three per cent, which represents the ad hoc rates of DEPB introduced in 2007,” Finance Secretary R S Gujral told a press conference.

There are 2,130 items on the DEPB list, of which 1,030 are also covered in the drawback schedule.

The remaining 1,100 items would now be incorporated in the new drawback schedule, taking its total count to about 4,000 items from the present 2,835.

With the DEPB facility, exporters got credit for customs duty paid on inputs used in making export goods. Under duty drawback, they receive duty-free scrips which can be used to pay import duties. The DEPB scheme was based on the assumption that the exporter used duty-paid imported inputs. Duty drawback neutralises levies paid on inputs. The revenue outgo towards the DEPB scheme has increased over the years and was Rs 8,700 crore last year.

“With withdrawal of the DEPB scheme, the government’s revenue forgone will be less. But our intention was to unify export promotion schemes, not maximise revenues,” said the Central Board of Excise & Customs chairman, S Dutt Majumder. He said the rates would be notified by the end of next week.

The ministry said the duty drawback rates for items under DEPB were recomputed taking into account prevailing customs duty rates. It was observed that for most items, the recomputed rate worked out to be far lower than the existing DEPB rates, even after removal of the ad hoc element of one to three per cent. Despite that, the ministry decided to have the minimum drawback rate at 5.5 per cent for most items, so that exporters were not adversely affected. For another 340 items, such as worsted woollen yarn, blankets and nylon twine, where the recomputed rate worked out to more than 5.5 per cent, the government has decided to provide the higher recomputed rate. The rate could be over 10 per cent for some items.

Ramu S Deora, President, Federation of Indian Export Organisations, said since reduction would be only to the extent of the stimulus component, added to DEPB rates in October 2008, the new rates will be, by and large, acceptable to the industry. He said even if the new drawback rates were a little less, the saving on account of transaction time and cost would offset the disadvantage.

Despite sluggishness in other sectors of the economy, exports turned out to be the silver line. They grew 54.2 per cent in the first four months of this financial year to touch $134.5 billion year-on-year. However, exporters were worried over discontinuation of the DEPB scheme.

Labels: Customs, Finance Ministry 0 comments

India may hike refined palm oil import duties

NEW DELHI/KUALA LUMPUR: India is considering an industry request to raise import duties on processed palm oil, government and industry sources said, after Indonesia lowered its export taxes on the product -- a move seen as dealing "a death blow" to Indian refineries.

India, the No 1 buyer of vegetable oils, has already begun importing more of refined, bleached and deodorised (RBD) palm olein from Indonesia ahead of Diwali, potentially leaving refining capacity idle.

With Indonesia, the biggest producer, now more than halving export taxes of refined palm oils in mid-September, Indian industry officials are pushing New Delhi to raise the base price, or tariff value, for refined palm oils.

"The domestic refining industry has been demanding $1,100-$1,200 per tonne tariff value on RBD palmolein," said a government source on Thursday who did not want to be named due to sensitivity of the issue.

The finance ministry did not comment on the issue as it usually refrains from making public statements to avoid speculation.

Importers are currently taxed 7.7 per cent duties based on the tariff value set at $484 a tonne, irrespective of purchase price -- a low price to pay and bring in processed edible oil cargoes at time when food inflation is still high.

Indonesia made minor cuts to export taxes of crude palm oil that forms the bulk of India's imports. But even with crude palm oil's import tax-free status in India, traders are shifting to refined products.

From last week, Indian traders have snapped up 50,000 tonnes of RBD palm olein for delivery in October to coincide with higher food demand during the Diwali festival.

Benchmark palm oil on the Bursa Malaysia Derivatives dropped 1.8 per cent on Thursday on concerns over the bleak global economic outlook although traders said festival demand could limit losses.

Indian domestic prices were also down. At 0727 GMT the most-active soyoil for October delivery on India's National Commodity and Derivatives Exchange was 0.6 per cent lower at 649 rupees ($13.429).

"The contract may fall to 620 rupees if cheaper imports will remain there for next few more weeks," said Vimla Reddy, an analyst with Karvy Comtrade.

India buys about 6 million tonnes of crude palm oil every year from Indonesia for its refiners to process into cooking oil and other food products.

Refining capacity in the country stands at 15 million tonnes and could turn idle if more refined palm oil is shipped in, traders estimate.

Food Minister KV Thomas this week expressed concern about Indonesia's move, which the head of Indian's leading vegetable oils industry association has said could be "a death blow" to the refining industry.

India's food ministry has since passed on the industry's request for higher tariff values to the finance ministry, the sources said.

Finance minister, Pranab Mukherjee, will take a final decision bearing in mind high food-driven inflation has forced the central bank to hike rates 12 times in the last 18 months.

"If the food ministry recommends any action on the demands of the domestic industry, we will inevitably examine it," a finance ministry official said.

The edible oils weight in India's wholesale price is 3.04 per cent, and the wholesale edible prices have moved up by 3.65 per cent since March 2011 until August.

The wholesale prices of edible oils were up 3.5 per cent in August from a year ago period. The WPI rose 9.78 per cent in August and is a major concern for policy makers.

"There is still plenty of room to move," said a palm oil analyst in Singapore.

"Raising the tariff value for refined palm oils will make it expensive but the inflation aspect can be mostly avoided as India will shift back to crude palm oil and still save its refiners," she added.

Labels: commodities 0 comments

Friday, September 16, 2011

Fraudulent Chinese firms swindle Indians in six innovative ways

Alarmed by the growing instances of fraud being committed by Chinese companies, to which Indian small and medium firms are falling victim, New Delhi has swung into action and has — for the first time — done an analysis on the types of trade disputes.

The government has also cautioned Indian companies against trusting business-to-business (B2B) sites before zeroing in on a Chinese partner. It has also asked the Indian missions in that country to help in establishing the authenticity of Chinese firms. There have been 66 disputes this year alone between January and July, the value of which exceeds $1.8 million. A majority of the disputes have taken place with companies based in Hebei province (29 cases) and Tianjin municipality (26 cases). The government is also circulating a list of 48 companies that committed fraud this year.

According to sources, the ministries of external affairs and commerce have analysed the cases, and have issued an advisory that identifies six ways in which fraud is being committed.

They are the following:

TYPE 1: A Chinese company gets in touch with an Indian company and invites the latter to visit China and meet company executives and local government officials as a confidence-building exercise. Before the Indians leave for China, the Chinese ask for cash towards gifts for local officials citing cultural values, to which the Indians agree. The Chinese pull out all stops and once the Indians return, all communications go unreplied. The Indian company loses on costs of transportation, accommodation and the gifts.

TYPE 2: The Indian firm finds a Chinese exporter from B2B portals and other online sources. The exporter insists that the Indian company should send a percentage of the total amount as advance. After payment, the Chinese firm reneges on the commitment.

TYPE 3: The Indian company finalises the deal and asks the Chinese for a sample of the products, which meet the desired standards. Orders are placed and the advance paid. The consignment reaches Indian shores and the payment is released after inspecting the bill of loading. The actual product, seen after release by Customs, is found to be substandard or at variance from the agreement. The Chinese brush aside all complaints and blame extraneous conditions.

TYPE 4: The Indians and the Chinese agree that the buyer (Indian) has to make an advance payment for the consignment. Once the advance is received, the Chinese partner goes slow and after repeated requests, asks for the remaining payment and cites delays, increased costs, supply problems, and even threat of no dispatch to exact the sum. The Indians pay up and the Chinese renege.

TYPE 5: The Chinese company, before or after finalisation of the deal, insists on `Notarisation of the Agreement’, cost of which has to be shared equally by both parties. The Indian company duly pays up its share. On return, the Indians are asked to pay extra towards ‘increased’ notarisation fees. The Indian firm risks losing its share of notarisation fees if it does not pay and the total amount if it pays up the extra fee.

TYPE 6: Before finalising the negotiations, the Indians receive an instruction to transfer the advance/full amount in a bank account different from that of the Chinese company. They comply and there is no answer after the amount is received. Later when the whereabouts of the consignment is enquired into, the Chinese respond that the said account is not the company’s account, or that the employee left the firm.

Labels: Countries 0 comments

DEPB Scheme to go on 30th September

NEW DELHI: Tax incentives for exporters will be lowered from Oct 1 as the government said Friday it will do away with the popular tax refund scheme, Duty Entitlement Pass Book (DEPB), and bring them under an existing duty drawback scheme from the beginning of next month.

At the same time, the number of items eligible for the drawback scheme have been increased by 1,100 to take the number of eligible items to 4,000.

After unveiling a transitory scheme for the 14-year old DEPB scheme, Finance Secretary R.S. Gujral said tax refunds on exports of 2,130 items will be reduced by 1 to 3 percent.

"An endeavour has been made to soften the reduction and transition from the DEPB to duty drawback scheme," Gujral told reporters.

Exporters of engineering, chemical, pharmaceuticals, marine and textile products are the major beneficiaries of DEPB scheme. Tax refunds under DEPB scheme resulted in the revenue loss of Rs.8,700 crore to the government exchequer last fiscal.

The revenue loss would be reduced significantly due to the replacement of the DEPB scheme, said Chairman of Central Board of Excise and Customs S.D. Majumdar.

The reduction in tax incentives might affect the growth of exports.

India's exports jumped 54.2 percent at $134.5 billion in April-August period, led by a sharp increase in exports of engineering goods.

Officials said the government will shortly notify "all industry rates" of duty drawback for the current fiscal.

The government had constituted a committee in January under Planning Commission member Saumitra Chaudhuri for formulating the "all industry rates" duty drawback.

The committee recently submitted its report.

"Recommendations of the committee form the basis for the rates being notified," the finance ministry said in a statement.

"The DEPB Scheme has been in existence since 1997. Presently, there are 2,130 line items covered under this scheme. Incorporating these items within the drawback schedule and assigning appropriate duty drawback rates for these items was a challenge both from a product classification perspective as well as from a drawback rate perspective," an official statement said.

"Consequently, the new drawback schedule will incorporate an additional 1,100 line items(approx.) which are being taken from the DEPB list. With this, the total number of items in the drawback schedule will number approximately 4000 line items, as against the present 2835 line items," the statement added.

Most items which are already covered under the duty drawback scheme will suffer a minor reduction in the existing rates.

"The reduction is mainly on account of the reduction in basic customs duty on crude petroleum from 5 percent to nil as well as a reduction in central excise duty on diesel from Rs.4.40 per litre to Rs.2.40 per litre," a finance ministry statement said.

Labels: Commerce Ministry, Customs, DGFT, Finance Ministry 0 comments

Thursday, January 6, 2011

Keeping home safe: Peak Customs duty to stay at 10%

NEW DELHI: The government is likely to keep peak Customs duty rate of 10% unchanged in the forthcoming budget to protect the domestic industry as a number of countries look to export their way to growth.

India had committed to lowering its import duty to the Asean level of 4.5%-5 % by 2010 but the financial crisis triggered economic turmoil caused it to pause the reduction.

“The general view is that the rate should be left untouched as domestic industry is still recovering,” said a government official privy to discussions.

Peak customs duty is imposed on more than 90% of imported goods and retaining it at the existing levels would help protect the domestic industry from cheap imports.

India’s domestic demand driven 9% GDP growth is a big contributor to the global demand and a number of countries are looking to step up exports to India.

These include the exports driven economies of Asia that face stagnant demand for their goods in the developed world.

Moreover, India has entered into number of regional and free trade agreements including thatwith Asean. Once in effect these arrangements also lead to reduction duties thereby impacting local industry here.

However, duty on inputs could be cut to boost domestic manufacturing and also help ease inflationary pressures.

The then Finance Minister P Chidambaram had last reduced peak customs duties to 10% from the present level of 12.5% in February 2007 budget.

The duties have remianed at that levels since then.

The industry lobbies have said a reduction in peak duties at this juncture could spell trouble for the domestic industry.

FICCI has said in its pre budget presentation that it would be in fitness of things if the alignment in customs tariff is calibrated with internal reforms.

Domestic manufacturers in sectors such as airconditioners, refrigerators, washing machines , picture tubes, specified plastics and other capital goods would benefit if the peak duty of 10% is retained.

India’s imports have risen 24% to over $221 billion in April-November 2010 from a year ago.

Labels: Budget, Customs, Finance Ministry 0 comments

Wednesday, January 5, 2011

Varanasi silk industry in trouble

In recent times, huge import of Chinese silk fabrics is posing a threat to the Varanasi silk industry, largely dominated by MSMEs. To voice this concern, the silk industry even observed a 1-day strike in late November 2010, but the Centre remained unmoved.

In recent times, huge import of Chinese silk fabrics is posing a threat to the Varanasi silk industry, largely dominated by MSMEs. To voice this concern, the silk industry even observed a 1-day strike in late November 2010, but the Centre remained unmoved.

The current scenario: There is 10% customs duty on silk fabrics and 30% on raw silk. On the contrary, the general trend followed worldwide is a lower customs duty on raw material over that of finished products.

To retain monopoly in the global silk fabrics export market, China has adopted a smart strategy, whereby it has increased raw silk prices to Rs 2,900 at present from Rs 1,750 in August 2010. However, current raw silk exports from China are almost nil, according to G K Kedia, convenor of Yarn Development Committee of the Banarasi Vastra Udyog Sangh (BVUS).

Consequently, China exports silk fabrics at skyrocketing prices and taking advantage of India’s reverse import duty structure, it is enjoying dumping of the same — adversely affecting the domestic silk fabric traders, which are mostly MSMEs.

In a major endeavour to protect the interest of the silk players, the Yarn Development Committee has recently written to the Finance Ministry and the Commerce Ministry requesting to abolish the import duty on raw silk and raise the same to 40% on silk fabrics.

“Huge Chinese dumping following inverted import duty structure, coupled with non-availability of requisite silk yarn is impacting the Varanasi silk industry,” said an official of BVUS to a correspondent on conditions of anonymity.

The problem

According to the government, the import duty on raw silk is higher to save domestic producers. But the point is that Indian raw silk is far below the quality of Chinese silk due to the following reasons:

•Poor cocoon quality

•Use of obsolete reeling machines to make yarn

Another disadvantage of Indian raw silk is that it needs twisting, while Chinese raw silk does not require twisting before use.

To add to the sector’s woes, domestic raw silk producers have raised prices at par with Chinese raw silk.

“Recent times have been really bad for the region’s silk players, primarily due to influx of Chinese silk at high costs,” said V Jamal, proprietor of Jamal Silk Palace, a small silk trader in Varanasi.

These factors have prompted domestic silk players to explore newer territories with zero import duty, such as Korea, Brazil, Iran and Vietnam.

Labels: Textiles 1 comments

Tuesday, January 4, 2011

Manmade fibre industry seeks govt help

Soaring cotton yarn prices followed by 25-40 per cent rise in man-made fibres (MMF) across various categories since October 2010 is making the export industry see red.

Export of MMF textiles declined by one per cent to Rs 3,852 crore during the second quarter ended June 2010, compared to the corresponding period in the previous year. The export scenario worsened with exports dropping by around 20 per cent to Rs 3,464 crore in the second quarter ended September 2011 as against Rs 4,910 crore during the same period last year.

The Indian MMF export sector was one of the few segments that was not affected by the global economic crisis. Exports during 2009-10 had registered a growth of nearly seven per cent at Rs 16,900 crore.

Industry insiders said the decline in MMF exports was because of significant rise in raw material costs, weak demand in Dubai and introduction of anti-dumping duties for synthetic and polyester yarn in consuming countries like Peru and Brazil coupled with an appreciated rupee.

“Polyester and viscose fibre and yarn prices have been increasing on a day to day basis. Manufacturers are also faced with erratic and unreliable supplies from fibre companies. This is making it difficult for exporters to plan their shipments and to adhere to delivery schedules,” said VK Ladia, chairman of the Synthetic and Rayon Textiles Export Promotion Council (SRTEPC).

Ladia said the industry will not be able to meet the MMF export target of $370 crore set by the government.

“I do not expect the just-ended quarter (Oct – Dec 2010) to be any better and the last quarter will not be able to make up for the loss. We will not be able to meet the target and our exports will be around $ 340 crore.”

Labels: Textiles 0 comments

EEPC seeks Technology Upgradation Fund Scheme

The Engineering Export Promotion Council (EEPC) has suggested the formulation of a Technology Upgradation Fund Scheme (TUFS) for the engineering sector. It feels this will help India achieve the target of doubling exports in three years.

The department of commerce is coming up with a strategy to double total exports in the next three years. The engineering sector (comprising 60-65 per cent SMEs) has been set an export target of $92 billion by 2013-14, up from an estimated $43 billion in 2010-11. To achieve the target, it has asked EEPC to identify major initiatives required in the Foreign Trade Policy.

The convenor of EEPC’s hand tools panel, Sharad Aggarwal, told Business Standard, “After a meeting on held December 27 with the department of commerce, EEPC India feels that the formulation of a TUF scheme will go a long way in not only helping engineering exports reach $92 billion by 2013-14, but also making India an important engineering export nation by 2020. The fund will help the SMEs in achieving the desired target.”

In spite of massive growth in the last few decades, the Indian engineering sector suffers from severe technological obsolescence and lack of economies of scale. High-value-added products contributed less than 10 per cent of total engineering exports in 2008-09. The need is to step this up to 20-25 per cent in the near future.

The main objective of the TUFS would be to provide the necessary policy wherewithal for modernisation of the engineering sector.

Technology upgradation would mean a significant step-up from the current technology level to a substantially higher one involving improved productivity, improvement in the quality of products and/or improved work environment.

It would also include installation of improved packaging techniques as well as anti-pollution measures and energy conservation machinery. Further, units that need to introduce facilities for in-house testing and quality control would qualify for assistance, as this is a case of technology upgradation.

The scheme will be available for sourcing of capital goods, machinery and equipment, clean technologies and tooling for production of value-added goods.

EEPC sought a corpus fund of Rs 500 crore for the scheme to boost R&D in the Indian engineering sector. The fund can be created through the public-private partnership (PPP) model, where the engineering industry may be asked to contribute 49 per cent while the government chips in with 51 per cent.

EEPC has also stressed the need for creation of a skill development fund for the engineering industry on the lines of the textile industry policy, to encourage capital equipment purchases on easy finance; a level playing field with respect to financing; a national raw materials policy; and a change in bank lending policies to treat VAT and excise duty receivables by exporters as the primary security for export credit.

Labels: Engineering 0 comments

Exports up 27 % in November

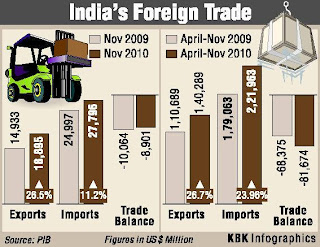

With exports registering a healthy growth of 26.5 per cent during November 2010 at $18.8 billion, the Commerce Ministry officials were confident that the overall exports would easily breach the $200 billion target set for this fiscal.

With the Western economies showing signs of revival and the formula to look out for new areas and markets for Indian products paying rich dividends, India's exports grew by 26.5 per cent year-on-year to $18.8 billion in November from $14.9 billion in the same month in the previous year.

On the other hand, imports rose by 11.2 per cent to $27.7 billion, leaving a trade gap of $8.9 billion, according to data released by the Commerce and Industry Ministry on Monday.

Oil imports increased by 2.31 per cent to $7.7 billion from $7.5 billion. Non-oil imports during the month grew by 15 per cent to $20.07 billion from $17.44 billion in November 2009.

During April-November 2010, shipments increased by 26.7 per cent to $140.2 billion from $110.6 billion in the year-ago period. Imports were higher by 23.9 per cent at $221.9 billion against $179 billion in the corresponding period last year. The trade deficit stood at $81.6 billion and is expected to be in the range of $120-125 billion.

During April-November, oil imports rose by 21.4 per cent to $64.8 billion from $53.4 billion in the year ago period. Non-oil imports too went up by 25 per cent to $157.11 billion from $125.64 billion. Sectors which performed well during April-November include engineering goods, petroleum and refinery items and cotton yarn.

The Federation of Indian Export Organisations (FIEO) predicted that exports could touch $220 billion, sharing the optimism of the Commerce Ministry. “Exports may reach the new milestone of $220 billion this fiscal,” FIEO President Ramu Deora said.

The government had fixed an export target of $200 billion for 2010-11. In 2009-10, shipments had declined by 4.7 per cent to $176.5 billion under the impact of global slowdown.

“The continuous increase in trade deficit is a worrying issue. The government should devise a strategy to reduce the trade deficit,” Mr. Deora said.

Labels: Commerce Ministry 0 comments

Govt reimposes 60% duty on sugar imports

With sugar production set to exceed domestic demand, the government has decided the zero duty regime on sugar imports to lapse, which in effect will restore 60% duty on the sweetener. Import duty on sugar was abolished in early 2009 to boost domestic supply because of a short fall in output in 2008-09 sugar year (October –September). Before that the duty on sugar import was 60%. The duty free regime was valid till December 31.

“There is no need for a fresh notification with the validity of duty free import notification on sugar lapsing. It will automatically revert to 60% duty. If required we can seek a reduction in duty later,”a senior government official said.

India had imported about 6mt of sugar since February 2009 to meet domestic demand. Sugar production in India, the world’s second largest producer, had declined to 14.7mt in 2008-09against the annual domestic demand of 23mt . In 2009-10, the production improved to 19mt, but it was still short of demand. However, in the current sugar year, production is expected to rise to 24.5mt and the country has now begun exporting the sweetener. Prices have also softened to Rs 30-32 per kg in retail from nearly Rs 50 a kg in mid-January 2010.

Meanwhile, the government would notify export of sugar under the open general licence (OGL) this week. The government might give mills three months to export sugar under the OGL. Agriculture minister Sharad Pawar had last month said the government had decided to allow mills to export about 5 lakh tones of sugar under the OGL. Mills may be allowed to export 2.5% of their average annual sugar output since 2008-09 under the OGL.

Labels: commodities 0 comments